UK housing market shows measured growth and stability through 2025

The UK housing market recorded modest but notable progress in 2025, with higher listing volumes, rising average prices, and improving confidence

By Nub News guest writer 12th Jan 2026

The UK housing market recorded modest but notable progress in 2025, with higher listing volumes, rising average prices, and improving confidence despite ongoing economic and regulatory pressures, according to Propertymark's Annual Property Review.

Sales Market: Listings and Prices Edge Up

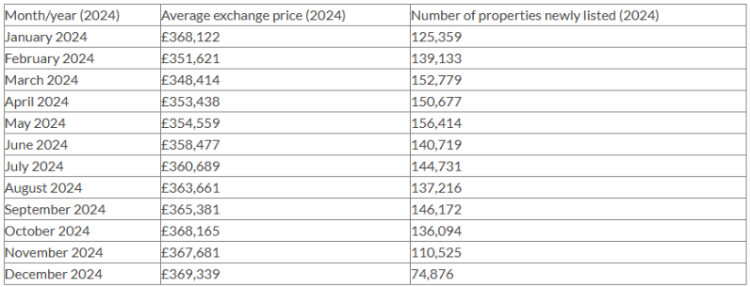

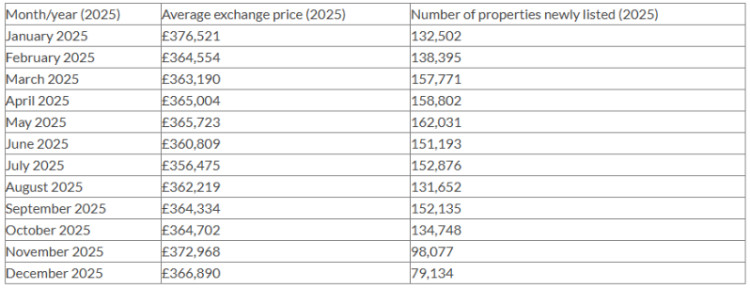

Between January and December 2025, a total of 1,649,316 residential properties were listed for sale across the UK. The average exchange price for the year stood at £365,179.

This compares with 1,614,120 properties listed in 2024, at an average exchange price of £361,501, meaning listings increased by 35,196 year on year, alongside a modest uplift in prices.

Market activity fluctuated throughout the year. The highest average monthly exchange price was recorded in November 2025 (£372,968), while the lowest occurred in July (£356,475). In terms of supply, May was the busiest month, with 162,031 new listings, whereas December was the quietest, with just 79,134 properties coming to market.

Industry Perspective

Commenting on the figures, Nathan Emerson, CEO of Propertymark, said 2025 marked a turning point for the housing market:

"Despite a myriad of challenges, 2025 has proven progressive for the housing market. We have witnessed inflation track downward to 3.2% and four base rate cuts throughout the year, all of which will contribute towards enhanced consumer confidence and affordability."

He noted that market uncertainty was heightened during key moments of the year, particularly ahead of Stamp Duty threshold changes in April and during the run-up to the Autumn Budget, as buyers and sellers paused decisions while awaiting fiscal clarity.

"Although 2025 has been a year of transition, we now sit in a much healthier position than twelve months ago, with the housing market displaying strong potential for the year ahead."

Property Transactions: Fall-Throughs Rise Slightly

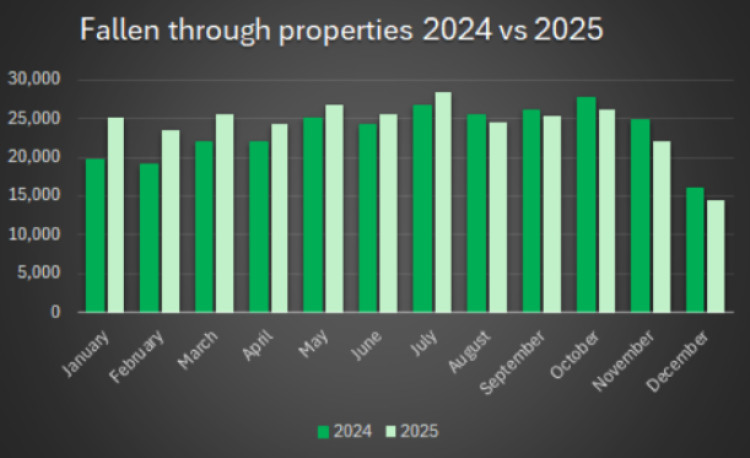

While overall market conditions improved, transaction fall-throughs increased in 2025.

- 2024:

- Transactions falling through: 240,681

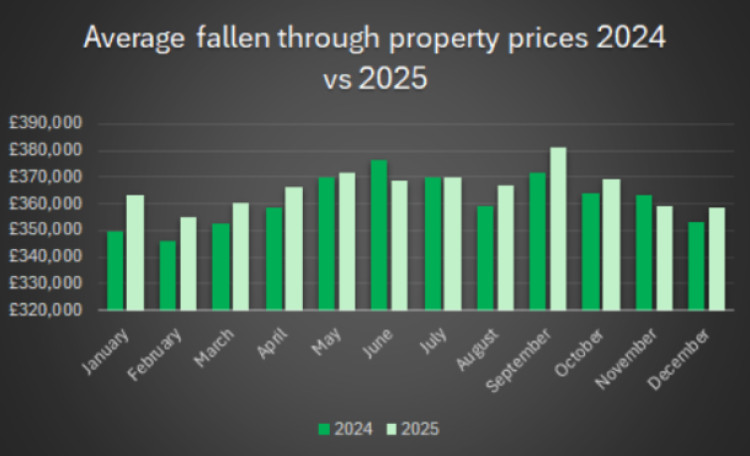

- Average price of fallen-through property: £362,143

- 2025:

- Transactions falling through: 250,092

- Average price of fallen-through property: £365,949

This represents an increase of 9,411 failed transactions, or 3.9% year on year.

The highest number of fall-throughs in 2025 occurred in July, with 28,261 transactions failing to complete. The lowest level was recorded in December, when 14,398 transactions stalled, and the average price of affected properties stood at £358,502.

Emerson highlighted the emotional and practical toll of failed transactions:

"Moving house is one of the most stressful moments that people experience in their lives, and that anxiety can increase significantly should a property transaction encounter an issue."

He added that reforms aimed at improving speed, transparency, and security in the buying and selling process are currently under consideration.

Rental Market: Supply Improves as Rents Hold Steady

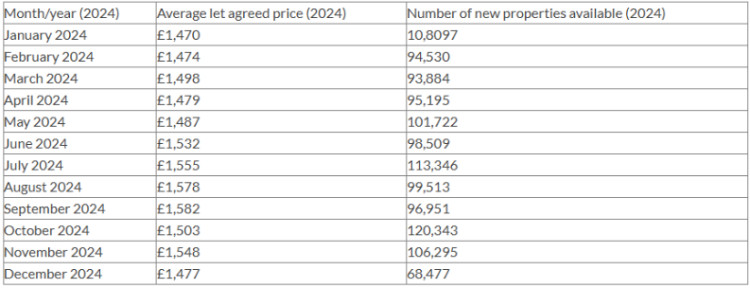

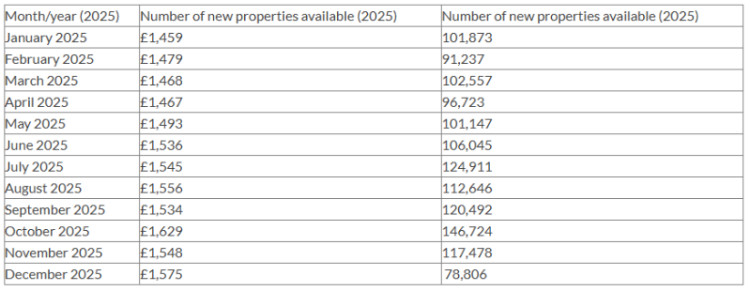

The rental sector saw an increase in activity during 2025, though average rents remained broadly stable.

- The average number of new rental listings per month rose from 99,739 in 2024 to 108,348 in 2025.

- Across the year, 1,300,514 rental properties were newly marketed.

Propertymark cautioned that this figure reflects tenant churn, rather than a net increase in rental stock.

The average let agreed across the UK stood at £1,505 per month in 2025, marginally lower than £1,511 in 2024. However, monthly figures varied depending on location and property type.

- Highest average rent (2025): October – £1,629

- Lowest average rent (2025): January – £1,459

- Busiest rental month: October

- Quietest rental month: December, with 78,806 new listings

Legislative Change Shapes the Rental Landscape

According to Emerson, the private rented sector is entering a period of adjustment:

"The UK's private rental sector has undergone profound changes over the last twelve months, with the Renters' Rights Act in England and the Housing (Scotland) Act being two of the most notable examples."

While these reforms have strengthened tenant protections, they have also increased pressures on landlords through tax complexity and future energy efficiency requirements.

"As we head into 2026, it may well become a year for adaptation… it remains imperative the sector attracts new long-term investment to keep pace with ever-growing demand."

Outlook

Overall, Propertymark's data suggests that while challenges remain, the UK housing market exited 2025 in a stronger position than it entered, supported by improving macroeconomic conditions, resilient demand, and steady rental performance.

Share: